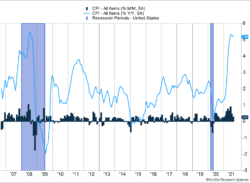

Two U.S. economic reports provided reassuring news about the economy. The inflation trend moderated in August. Consumer price inflation (CPI) rose 0.3%, down from 0.5% the previous month and below estimates of a 0.4% increase (Figure 1). Excluding food and energy, prices increased just 0.1%.

Key Points for the Week

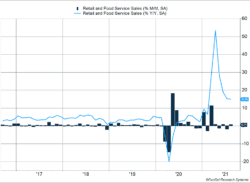

- Retail sales jumped 0.7% last month, trouncing expectations for a 0.7% decline.

- Consumer prices rose 0.3% and core inflation rose just 0.1%, continuing the trend toward lower inflation.

- Chinese retail sales disappointed, rising just 2.5% compared to expectations for 7.0% growth.

Consumer demand remained strong. Retail sales jumped a surprising 0.7%. Economists expected retail sales to drop by 0.7%. Demand moved from in person to online. Sales would have grown even more if motor vehicles and parts hadn’t dropped 3.6% from the previous month (Figure 2).

The strength in U.S. data contrasts to weakness in China. Chinese retailers experienced growth of just 2.5%, missing forecasts for 7%. The reemergence of strict lockdowns in China pressured sales.

Stocks dipped for the second straight week. The S&P 500 dropped 0.5%. The MSCI ACWI slid 1.0%. The Bloomberg U.S. Aggregate Bond Index was roughly unchanged for the second straight week. The Federal Reserve meets this week to determine whether to slow purchases of government bonds this year or wait until next year.

Figure 1

Tough Decision

When the Federal Reserve meets this week, its members will face a difficult choice on whether to start reducing purchases of bonds this year or continue to support the economy at current levels. The Fed currently buys $120 billion of government-backed bonds each month — $80 billion in Treasury debt and $40 billion in mortgage-backed securities. The goal of the purchases is to push long-term interest rates lower, making it cheaper for corporations and homebuyers to borrow money or refinance loans.

The weak jobs report two weeks ago raised some uncertainty about whether the economy was strong enough to warrant removing some of the support. Last week’s reports on inflation and retail sales gave the Fed more options as the pressure from inflation abated while retail sales were strong.

CPI rose only 0.3% last month, and the trend is slowing. Inflation rose 0.5% in July and 0.9% in June. Core inflation, which excludes the more volatile food and energy categories, rose a scant 0.1% as several mobility-related items dropped in price. Price declines in airline tickets, rental cars, and hotels all helped to keep inflation under tighter control. Used car prices also declined.

The slowing trend reduces the pressure on the Fed to taper, even though inflation has still increased 5.2% over the last year.

Figure 2

Retail sales give the Fed reasons to slow bond purchases. The gain of 0.7% shows the economy remains relatively strong. Rather than curtail purchases in the face of increased COVID-19 cases and benefit reductions, people transferred their spending online. Retail sales would likely have been stronger if auto manufacturers had been able to adequately supply inventory.

The Fed seems likely to guide the market toward bond tapering at the beginning of the year. The slowing inflation trend gives the Fed reason to pause. The Delta variant seems likely to slow some activity, and retail sales data don’t seem strong enough to overcome the weak jobs report. The Fed could surprise us, but it seems focused on doing all it can within reason.

While markets are focused on what the Fed will do, another question is: How much does it matter? Last week’s data points make it easier to say “Not much.” Inflation seems to be moving toward a reasonable level. Retail sales show the consumer remains strong. A slight decrease in bond purchases is unlikely to derail this economy.

The decision on whether to taper or not may cause short-term volatility. Investors may have become too reliant on the Fed and fear how other investors could respond to a less friendly interest rate environment. In the intermediate term, the decision on when to taper is unlikely to be a key driver of your portfolio’s long-term value.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.cnbc.com/2021/09/15/chinas-retail-sales-grew-far-slower-than-expected-in-august.html

Compliance Case #01136435